Why Not Tax the Rich More?

Is taxing the rich truly the solution? Uncover the hidden motivations and power plays that influence our tax policies.

Is it really better for the government to cut jobs instead of raising taxes on the wealthiest 1%? This question pops up every now and then, and it's worth looking into why things aren't as straightforward as they seem.

Why Not Just Raise the Taxes?

Some folks mention that the government is encouraged by influential donors not to alter the current tax system. In simpler terms, the rich pay a pretty penny to keep things as they are. If taxes go up, who knows how campaign donations might change?

There's also the argument that billionaires have ways to manage their wealth such that they're not as affected by higher taxes. They might use trusts or other financial tools to evade what you'd expect would be hefty tax bills.

Class Warfare in Disguise?

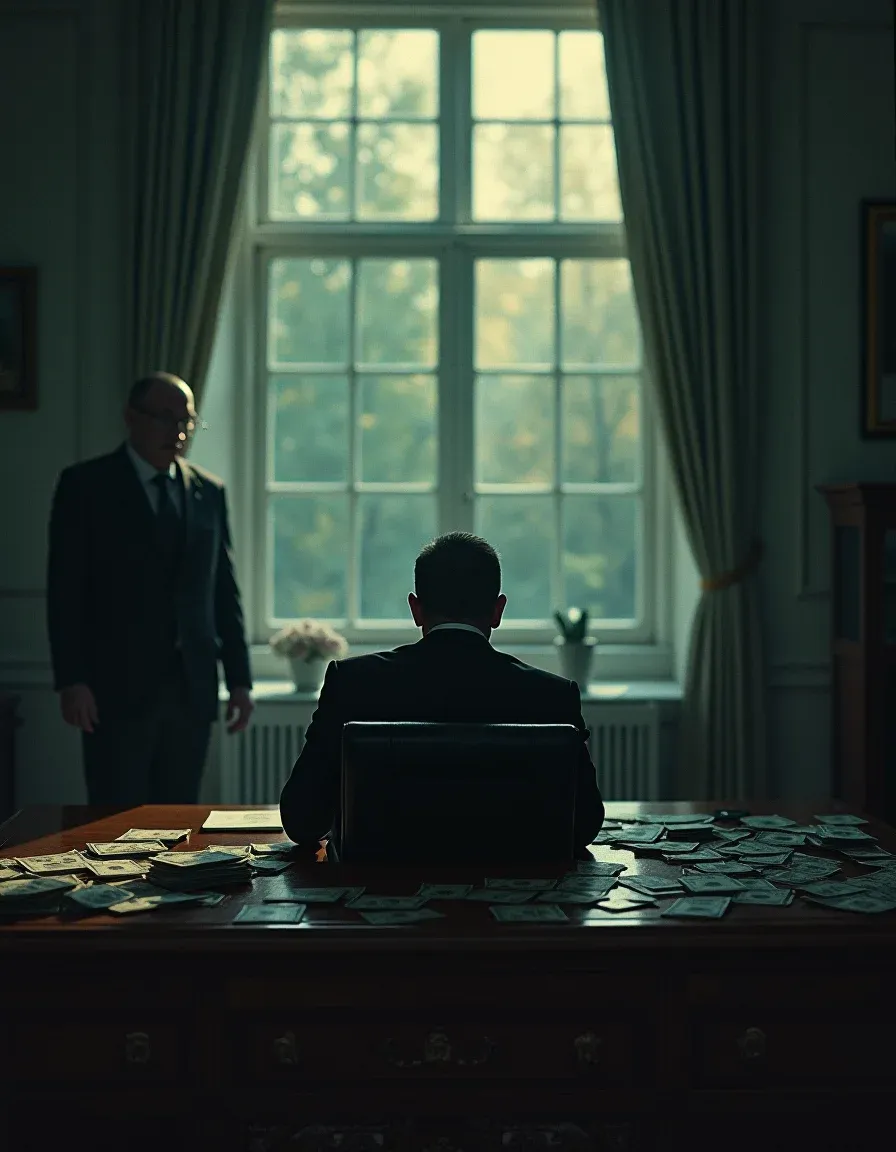

Many see this issue as a kind of silent class warfare, where the wealthy win because they can influence policy crucially. It's not just about saving money for the government; it's about power dynamics. A few believe that the billionaires are running the show behind the scenes, influencing decisions to benefit themselves.

One comment suggests that those at the top don't make their billions to just hand it over to the government. They want a return on what they invest, including their investment in getting policies crafted in their favor.

Don't Be a Sucker

The chatter about reform isn't just about taxes. It delves into whether there's something deeply broken about how we govern our finances. Some suggest we need a complete overhaul rather than just squeezing more money out.

This all boils down to the argument that you should vote with your wallet in mind. Understanding what's truly in your interest might help shift the balance of power.

Rethinking the System?

Perhaps a bigger question remains. Are these policies reflective of what citizens really want, or is it an issue of not having the means to advocate better? Progressive tax systems are designed to help with inequality, but enacting such changes might involve battling some hefty resistance from those sitting at the top.

So, next time you hear about cutting jobs or the idea of taxing the rich more, think about the bigger picture. Who benefits, who loses, and what can the average Joe do about it?