Choosing Where Your Money Goes: Nephew's Tuition vs. Dog's Vet Bills

Caught between funding your nephew's tuition and vet bills for a furry friend? Learn how to navigate financial responsibilities and set firm boundaries!

A Question of Financial Responsibility: Help or Hold Back?

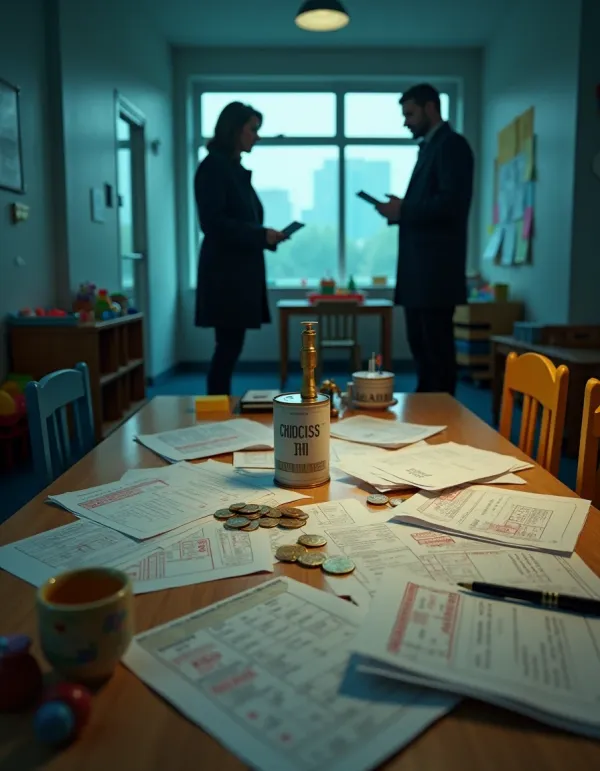

Hey there! Have you ever been in a pickle, juggling who gets a slice of your hard-earned cash? It's a real dilemma. Let me throw a scenario at you: Imagine being asked to pay for a nephew's college tuition while also shelling out for a cousin's dog's medical bills. Sounds tricky, right?

Now, some folks might say, "Why is it your responsibility to pay for your nephew’s tuition?" It's a valid point. Sure, the dog's cuddly and all, but shouldn’t family come first? Still, it’s all about who you're close to and what truly matters to you. You’re not obligated to spend your money on someone just because they're family, especially if your brother and his family appear to prioritize other expenses over their child's education.

Understanding Financial Priorities

Let’s break it down. When it comes to managing finances, it often boils down to setting clear priorities. This means sometimes saying "no," and sticking to it. People will understand that your money is your own, and you've every right to choose how you spend it, whether it’s on a furry friend or not. Some people prioritize their pets over certain human relationships, which might seem strange, but hey, everyone’s got their quirks.

Interestingly, there's a broader conversation around financial responsibilities within families. Did you know some places have filial responsibility laws? These laws could, in theory, oblige adult children to care for their impoverished parents, though they're not commonly enforced. Knowing about them might not change your decision, but it adds an interesting layer to consider.

Setting Boundaries

So, the takeaway? It’s okay to set boundaries on financial support. Some advice to keep in mind: stop broadcasting what you’re paying for. It saves you from being viewed as the go-to ATM by family members, which can be a real headache. If they never ask, they never put you in the awkward position to say "no." You’re not being mean; you’re being smart and protecting your well-being.

In the end, remember, your finances are yours, and it’s okay to make choices that align with your values and comfort. There’s no shame in saying no, even to family. Stay strong, friend!